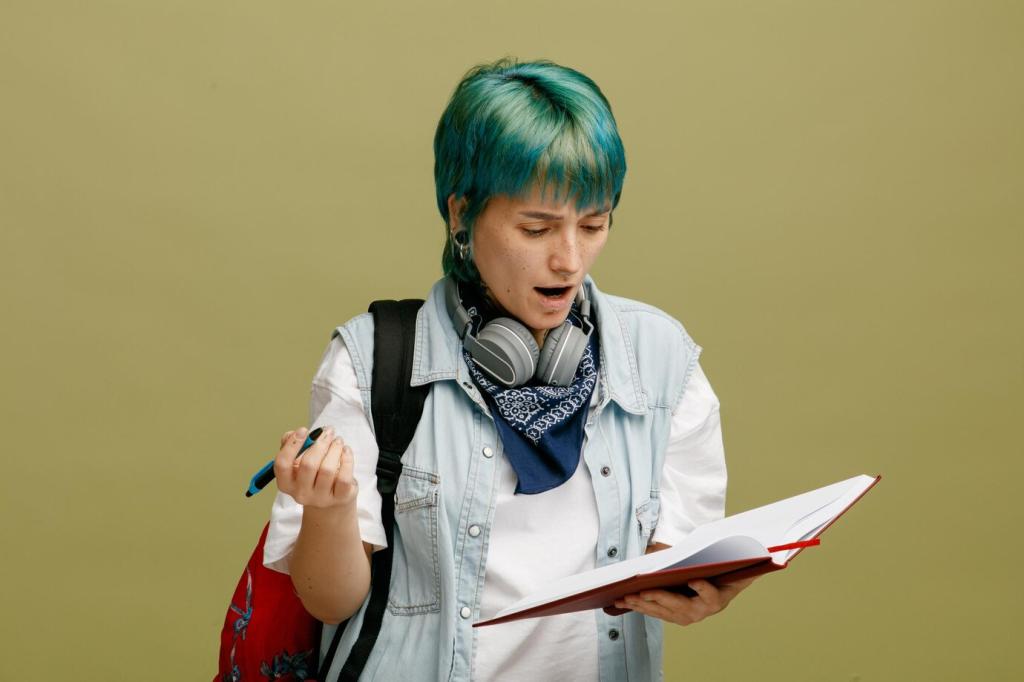

Smart Spending: Needs, Wants, and Trade-offs

List your real needs: transportation, school supplies, lunches, basic phone service. Price them monthly so you can predict costs, then protect those dollars first. Post your essentials list to inspire others, and ask peers if you missed anything important.

Smart Spending: Needs, Wants, and Trade-offs

Use a twenty-four-hour pause before purchasing non-essentials. Unfollow tempting promo emails, shop with a list, and compare unit prices. Maya, 15, cut her impulse purchases in half by parking items in a wish folder. Try it and report your results below.